25+ Compound interest finance

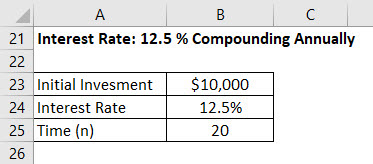

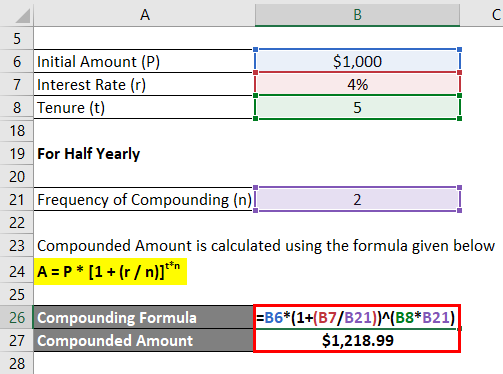

Thought to have. Divide the Rate of interest by a number of compounding period if the product doesnt pay interest annually.

Make A Dollar Bill Money Notepad Chica And Jo Dollar Bill Dollar Bill Origami Money Gift

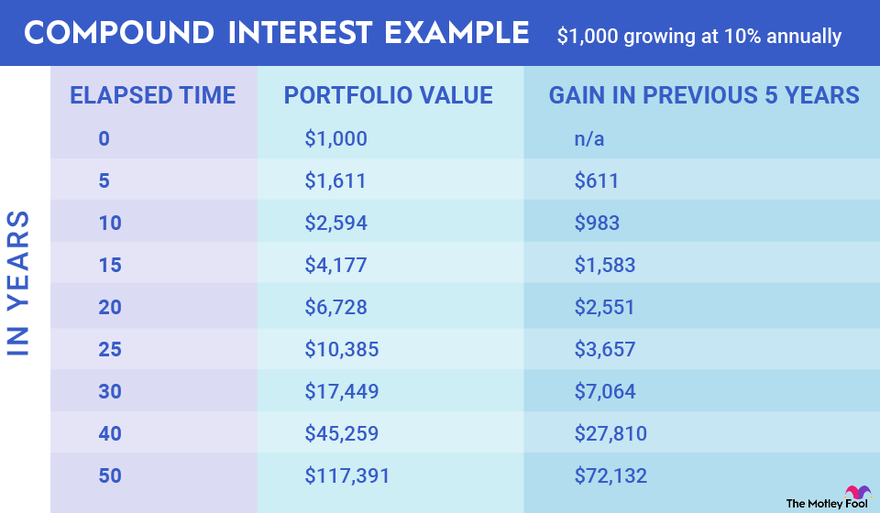

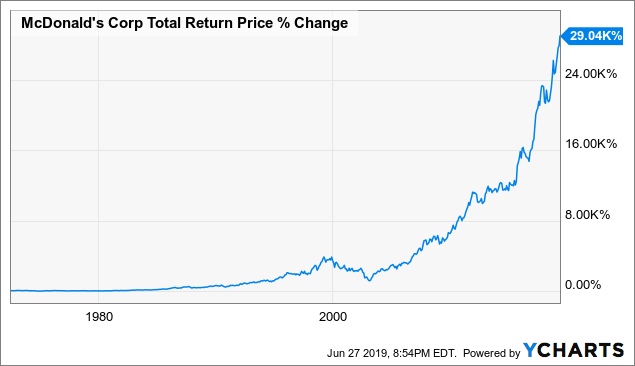

Since 1970 the highest 12-month return was 61 June 1982 through June 1983.

. How to Use the Compound Interest Calculator. Compound Interest A P. Your 105 earns 5 interest or 525.

Savings accounts at a financial institution may pay as little as 025 or less but carry significantly lower risk of loss of principal balances. With compound interest even if you dont make any additional deposits your earnings will accelerate. Looking for accounts that make 12 in compound interest.

Compound interest is interest earned on both the principal and on the accumulated interest. Compounding frequency could be 1 for annual 2 for semi-annual 4 for quarterly and. 2 nd year compound interest is 1030 3 3090 Principal at the beginning of 3rd year is 1030 3090 106090.

The interest typically expressed as a. That then gives you 110 to start with in year two Then a 10 return on 110 gives you 11 in interest in the second year. Finance Compound Interest Calculator CAGR Calculator Margin Calculator Salary to Hourly.

Substituting the values 5624320 50000 624320. Say you have an investment account that increased from 30000 to 33000 over 30 months. To compute compound interest we need to follow the below steps.

Find the sum a 30550 b 31250 c 25670 d 35400 View Answer Ans. An initial deposit of 100 earns 5 interest or 5 bringing your balance to 105. In the first year you start with 100 and receive 10 in interest 100 x 10.

Compound interest or compounding interest is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. For example if one person borrowed 100 from a bank at a compound interest rate of 10 per year for two years at the end of the first year the interest would amount to. How can compound interest help you grow your savings.

Forrest is a personal finance entrepreneurship. Simple Interest vs. The interest earned in the previous year will start to make money in the following years.

Each year this continues and the interest grows. The lowest 12-month return was -43 March 2008 to March 2009. It is given that.

Find out the initial principal amount that is required to be invested. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account. Finance for Non Finance Managers Course 7 Courses Investment Banking Course 123 Courses 25 Projects Financial Modeling Course 7.

Calculate the amount and the compound interest on 5000 in 2 years when the rate of interest for successive years is 6 and 8 respectively. Use our compound interest calculator to see how your savings or investments might grow over time using the power of compound interest. Compounding is a very intriguing concept in finance but some assumptions sometimes do not make.

Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. To begin your calculation take your daily interest. 100 10 1 year 10.

Your balance is 11025. Daily compound interest is calculated using a simplified version of the formula for compound interest. 1 st year compound interest is 1000 3 30 principal at the beginning of 2nd year is 1000 30 1030.

50000 2625 2625 2625 5624320. Your balance of 11025 earns 5 interest or 551. What a great news.

The difference between compound interest and simple interest on certain sum of money in 2 years at 4 per annum is 50. Check out these investment options to build wealth and make passive income. Compound interest can turn a small amount of money today into a large amount of money over the space of 10 20 or 30 years.

Principal 5000. They have target returns of 10 to 25 making them a great option for investors looking to earn compound interest on their money. Here we discussed how to calculate Daily Compound Interest with examples Calculator and excel template.

Interest is the cost of borrowing money where the borrower pays a fee to the lender for the loan. This is a very high-risk way of investing as you can also end up paying compound interest from your account depending on the direction of the trade. In finance interest rate is defined as the amount that is charged by a lender to a borrower for the use of assetsThus we can say that for the borrower the interest rate is the cost of debt and for the lender it is the rate of return.

Compound interest is widely used instead. How to calculate daily compound interest. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Thats assuming you let the uninterrupted compound interest continue to work for you. Note here that in case you make a deposit in a bank eg put money in your saving account from a financial perspective it means that you. Compound Interest Explanation.

If This Doesn T Get You To Save And Invest I Don T Know What Will Budgeting Money Money Saving

What Is The Advantage Of Investing Early For Retirement Quora

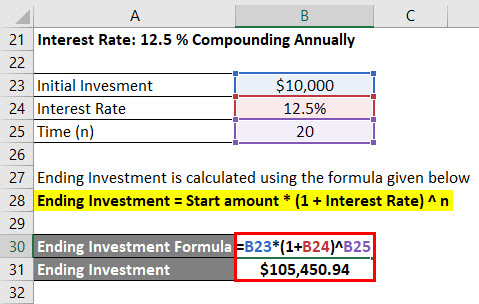

Daily Compound Interest Formula Calculator Excel Template

25 Simple Ways To Make Extra Money The Tiny Traveler Blog Extra Money Money Maker Simple Way

Accounts That Earn Compounding Interest

Daily Compound Interest Formula Calculator Excel Template

Compound Interest The Eighth Wonder Of The World Onenumber

The Snowball Effect How To Compound Your Wealth With Dividend Growth Stocks Seeking Alpha

How To Make A Real Money Notepad Step By Step Instructions Christmas Money Graduation Money Gifts Money Gift

Consistency Is The Key To Achieving And Maintaining Momentum Good Life Quotes Darren Hardy Simple Quotes

Daily Compound Interest Formula Calculator Excel Template

Compounding Formula Calculator Examples With Excel Template

Defining Compounding Josh Mcalister Awm Capital

How Compounding Is Not The Secret To Growing Your Cash Daily Mail Online

Drip Stocks 15 No Fee Dividend Aristocrats Sure Dividend Dividend Drip Stocks Dividend Reinvestment Plan

Drip Stocks 15 No Fee Dividend Aristocrats Sure Dividend Dividend Drip Stocks Dividend Reinvestment Plan

Daily Compound Interest Formula Calculator Excel Template